Intel Financial Risks, Layoffs, Foundry Ambitions

Intel is poised for a critical juncture. The company just unveiled financial results that underscore the deep challenges facing the semiconductor giant. It could announce massive layoffs and increased focus on its foundry business.

Amid reports of a massive workforce reduction potentially impacting over 20% of its global staff, the company is aggressively pushing forward with a bold transformation aimed at reinventing itself as a dominant force in contract chip manufacturing, directly challenging the long-held supremacy of Taiwan Semiconductor Manufacturing Co. (TSMC).

CEO Lip-Bu Tan delivers the opening keynote at Intel Vision 2025 (Source: Intel)

CEO Lip-Bu Tan delivers the opening keynote at Intel Vision 2025 (Source: Intel)

Navigating financial headwinds

The Q1 2025 earnings report, released today, provided the first public financial update under Lip-Bu Tan’s leadership. Tan stated that the first quarter was “a step in the right direction” but acknowledged there are “no quick fixes” to regain market share and drive sustainable growth.

The financial results exceeded previous expectations. Intel reported revenue of $12.7 billion, which was flat year over year and $0.5 billion above the midpoint of Intel’s January outlook. The company characterized the Q1 results as “Solid” and “above expectations” regarding revenue, gross margin, and EPS.

Profitability also exceeded earlier forecasts. While analysts predicted adjusted earnings per share (EPS) ranging from a loss of $0.14 to a minimal profit of $0.01, the actual non-GAAP EPS attributable to Intel was $0.13 for Q1 2025.

This was $0.13 above the January outlook but still represented a decrease of 28% from the first quarter of 2024 ($0.18). The GAAP loss per share was $(0.19). Additionally, the non-GAAP gross margin for the quarter was 39.2%, 3.2 percentage points above the January outlook but down 5.9 percentage points year-over-year.

The server segment is reportedly underperforming due to intense competition. The Client Computing Group (CCG), focused on PC processors, reported revenue of $7.6 billion, down 8% year-over-year.The outlook for the second quarter of 2025 reflects ongoing uncertainty.

Intel forecasts revenue between $11.2 billion and $12.4 billion, expecting non-GAAP EPS of $0.00 and a gross margin of 36.5%. Intel CFO David Zinsner noted that the “current macro environment is creating elevated uncertainty across the industry” in the outlook.

Analysts caution that any potential short-term boost from customers stockpiling PC chips due to anticipated tariffs might mask these underlying weaknesses and could lead to inventory issues later.

Sweeping workforce reduction

Against this backdrop of financial headwinds, Intel is undertaking a significant restructuring, with reports suggesting a workforce reduction exceeding 20%. This move, potentially impacting over 21,000 employees, is aimed squarely at significant cost optimization and improving operational efficiency. It aligns with Intel’s goal of reducing costs by $10 billion in 2025.

The layoffs aim to streamline management layers, particularly within engineering, and sharpen the company’s focus on core product development. Analysts consider this a necessary, albeit painful, step to address persistent issues like high costs and slow decision-making.

“Many teams are eight or more layers deep, which creates unnecessary bureaucracy that slows us down,” wrote Lip-Bu Tan to Intel’s employees. “I have asked the [Executive Team] ET to take a fresh look at their respective orgs, with a focus on removing layers, increasing spans of control and empowering top performers.”

“I’m a big believer in the philosophy that the best leaders get the most done with the fewest people,” he argued.

However, concerns remain about the potential impact on employee morale and innovation capabilities. This reported reduction follows a previous 15% workforce cut in August 2024.

The IDM 2.0 pivot to foundry

Central to Intel’s long-term strategy is its “IDM 2.0” plan, a fundamental shift away from its traditional integrated device manufacturer model toward becoming a major global provider of contract semiconductor manufacturing services—a foundry.

It involves designing, manufacturing, and selling its own chips, but crucially, also fabricating chips for external clients, including potential competitors. As part of this pivot, Intel is progressively separating its chip design and manufacturing operations, with Intel Foundry Services (IFS) evolving into an increasingly autonomous entity.

Furthermore, this separation aims to build trust with prospective foundry customers and could pave the way for a future spin-off. Intel has positioned IFS as the “world’s first systems foundry for the AI era,” emphasizing a focus on advanced manufacturing and the high-growth AI market.

Global foundry footprint

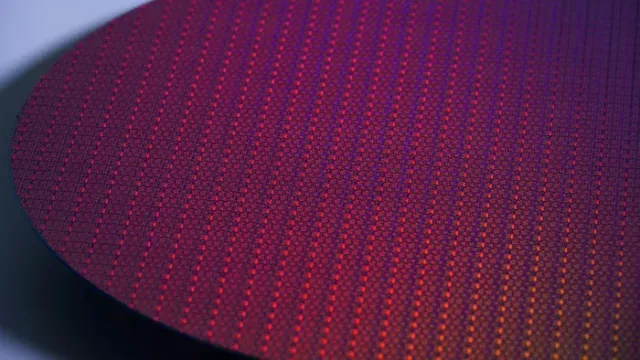

A significant global manufacturing footprint and an aggressive technology roadmap back Intel’s foundry ambitions. The company operates 15 wafer fabrication facilities in 10 locations worldwide.

It has extensive operations in Arizona, New Mexico, and Oregon in the United States. Internationally, key manufacturing sites include Ireland and Israel.

Intel is currently undergoing a massive expansion projects globally, including building two new leading-edge fabs in Arizona with investments exceeding $32 billion, expanding advanced packaging in New Mexico with over $4 billion investment, and constructing a new 300mm logic/foundry fab in Oregon.

A highly ambitious project in Ohio involves over $28 billion to build two new fabs, although the timeline has faced significant delays, with operations now expected between 2030 and 2032.

Israel’s Fab 38 at Kiryat Gat (Source: Intel)

Israel’s Fab 38 at Kiryat Gat (Source: Intel)

International expansions include Fab 34 in Ireland, which began high-volume production of the Intel 4 process and will come to 3nm (Intel 3) production in 2025; Fab 38 in Israel, which produces advanced chips using EUV lithography; and new advanced packaging and assembly facilities in Malaysia and Poland.

Advancing technology roadmap

Intel’s technological progress is critical to its foundry strategy. The company is nearing the completion of its “Five Nodes in Four Years” (5N4Y) strategy. Its Intel 3 process, utilizing EUV lithography, is already in high-volume manufacturing in Oregon and on trials by external customers.

The highly anticipated Intel 18A process node, considered crucial for Intel’s future, is on track for manufacturing readiness by the end of 2024. It features innovative technologies like RibbonFET and PowerVia and could surpass current TSMC offerings in performance and efficiency.

Additionally, Intel is developing Intel 14A, its third advanced node available to external customers. Using high-NA EUV lithography, it will start risk production in late 2026.

Securing customers

Early signs indicate that Intel Foundry Services is gaining traction with significant customers. Expanded collaboration with Amazon Web Services (AWS) involves a multi-year, multi-billion-dollar framework, with IFS manufacturing an AI fabric chip using the advanced Intel 18A process and a custom Xeon 6 chip on the Intel 3 process.

Microsoft has also committed to using Intel’s 18A process for a future chip design, reportedly valued at $15 billion in total deal value for the foundry business.

Furthermore, Intel secured a contract for up to $3 billion under the U.S. government’s CHIPS Act for the Secure Enclave program, which aims to expand the trusted manufacturing of leading-edge semiconductors for national security. As of February 2024, Intel’s total lifetime deal value for its foundry business had surpassed $15 billion.

Intel is pursuing other major players like Nvidia and Alphabet’s Google as potential foundry customers. Reports suggest Nvidia, Broadcom, and AMD are evaluating or have conducted early test runs on Intel’s 18A process.

Competing with the Leader

While Intel is making progress, it faces a formidable competitor in TSMC. The Taiwanese manufacturing giant recently held its North America Technology Symposium, where it unveiled its next-generation A14 process node and highlighted advancements in packaging like CoWoS and SoW-X. These advancements aim to meet the “insatiable need for more logic and high-bandwidth memory (HBM)” driven by AI.

TSMC’s CEO, Dr. C.C. Wei, denied reports of discussions regarding a joint venture or technology transfer with Intel, even as sources familiar with TSMC’s operations suggested transforming Intel’s fabs to match their standards would be costly and lengthy.

Despite this, TSMC has significantly expanded its own U.S. investment commitment, planning six new fabs and two advanced packaging facilities. Competition in areas like advanced packaging is intensifying.

Substantial government incentives, particularly through the U.S. CHIPS and Science Act, support Intel’s foundry push. Intel will receive up to $7.86 billion in direct funding for its manufacturing and advanced packaging projects across multiple U.S. states.

In addition to the $3 billion for the Secure Enclave program. Intel will also benefit from a 25% Investment Tax Credit on qualified investments exceeding $100 billion. The CHIPS Act funding also includes allocations for workforce development.

Outlook under the new leadership

Today’s Q1 2025 earnings report is the first under the leadership of Lip-Bu Tan, who assumed the role of CEO in March. He prioritizes manufacturing revival and a strong push into the AI sector, including revamping operations and actively pursuing new foundry customers.

“Intel was once widely seen as the world’s most innovative company. There’s no reason we can’t get back there, so long as we drive the changes needed to improve,” Tan concluded.

The coming months will be critical in determining whether Intel can successfully pivot and regain leadership in the evolving semiconductor landscape.

Sign up to our newsletter

Receive our latest updates about our products & promotions